Posts Tagged: Daniel Sumner

Californians will pay more for pork under Prop. 12

The Prop. 12 pork panic is overblown, say UC agricultural economists, but so are the new law's benefits to hogs

California's Proposition 12 will soon require farms to add space for certain farm animals, including breeding pigs, or mother sows. As the January 2022 date for full implementation of Prop. 12 approaches, some pundits warn of upcoming bacon shortages and up to 60% higher pork prices, while others downplay any negative effects on Californians.

What are the real impacts of Prop. 12, which was approved by California voters in 2018?

UC Davis economists estimate that California pork consumers will lose $320 million per year (roughly $8 per person) from the market impacts of Prop. 12. California consumers will pay about 8% more for pork regulated under Prop. 12 and will consume around 6% less of that pork per year.

Co-author Richard Sexton, UC Davis distinguished professor of agricultural and resource economics, noted, “The roughly 9% of North American sows affected will each get about 20% more housing space. But, the additional space will be for those sows that already have more space, not those confined in small individual stalls.”

California's Prop. 12 is now set to be implemented as planned following the 9th Circuit Court's recent rejection of legal challenges. Republican senators from Iowa have proposed federal legislation to stop implementation of Prop. 12, fearing economic damage to their hog farmers, but federal action is unlikely. Meanwhile, Prop. 12 supporters claim that the new regulations will give more space to sows confined to stalls so small that they can't turn around.

Prop. 12 requires each sow whose piglets are raised for uncooked cuts of pork sold in California – about 9% of North American sows – to have a minimum of 24 square feet of space. Because Prop. 12 applies only to sows, not to their offspring who are raised for meat, it will apply to well less than 1% of the 90 million North American hogs.

Around 30% of North American sows are already in group housing with 20 square feet each, rather than confined in stalls. The high cost of converting stalls means that the California pork supply will come from sows already in group housing. “Thus,” said Sexton, “the California Prop. 12 regulations will not help those sows confined in stalls to gain more space and mobility.”

The added costs of 20% more space for group-housed sows that are transitioned to comply with Prop. 12 – plus the costs of segregation, product tracing and new labeling – will cause the cost of regulated pork products in California to rise by about $0.25 per pound. The UC Davis research also indicates almost no change in the prices of pork products sold outside of California.

To learn more about the coming impact of Prop. 12 on California consumers and the North American pork supply chain, read the full article by Ph.D. candidateHanbin Lee, Sexton and distinguished professor Daniel A. Sumner, all in the UC Davis Department of Agricultural and Resource Economics: “Voter-Approved Proposition to Raise California Pork Prices.” ARE Update 24(6): 5–8. UC Giannini Foundation of Agricultural Economics: https://giannini.ucop.edu/filer/file/1629132628/20134.

ARE Update is a bimonthly magazine published by the Giannini Foundation of Agricultural Economics to educate policymakers and agribusiness professionals about new research or analysis of important topics in agricultural and resource economics. Articles are written by Giannini Foundation members, including University of California faculty and Cooperative Extension specialists in agricultural and resource economics, and university graduate students. Learn more about the Giannini Foundation and its publications at https://giannini.ucop.edu.

Organic agriculture tops $3 billion in California farm gate sales

Organic farming continues to expand in California and now includes more than 360 commodities, according to a new University of California report. The number of organic growers, acreage and farm gate sales revenue is reported by commodity, county, region and statewide in the new “Statistical Review of California Organic Agriculture, 2013-2016.” The data are collected from farms that register as organic with the California Department of Food and Agriculture.

“This report highlights the incredible diversity and abundance of organic crops being grown across so many different geographic regions in the state, which reflects California's leading role in this production sector,” said Houston Wilson, director of the new UC Organic Agriculture Institute.

“Dairies continue to lead by value of organic production,” said Rachael Goodhue, UC Davis professor of agricultural and resource economics and coauthor of the report.

The number of organic growers in California jumped from 2,089 in 2013 to 3,108 in 2016. The top 10 organic commodities for sales value in 2016 were cow milk, strawberries, carrots, wine grapes, table grapes, sweet potatoes, almonds, raspberries, salad mix, and chicken eggs.

“This review is critical to understand the changes in the fast-growing organic agriculture sector in the state where more than 50% of the nation's organic vegetables and fruits are produced,” said Joji Muramoto, UC Cooperative Extension organic production specialist at UC Santa Cruz and coauthor of the report. “It provides statistics of all organic commodities produced across the state as well as at county level. This is the primary reference to learn about the size, diversity, and trends of organic agriculture in the state.”

In 2016, California organic sales were $3.1 billion with an average of $1 million in sales per farm, but revenue varied widely among farms. For example, San Diego County had the most organic growers (313) in 2016, but Kern County's 47 organic farmers earned the most in total organic sales: $381 million on 49,727 acres, excluding pasture and rangeland, according to Muramoto.

“The average gross income of organic farms increased 14-fold from 1994 to 2016, reaching $1 million in 2016,” Muramoto said. “However, 77% of growers received less than $500,000 per year and 22% of growers who made $500,000 or more per year received 94% of the total gross sales, showing the income concentration among organic growers in the state.”

The statistical review of California's organic agriculture had been published since 1998 by the late Karen Klonsky, UC Cooperative Extension specialist, and her team after statistics for organic agriculture became available in 1992 as a result of the California Organic Food Act.

The last report published by Klonsky, who passed away in 2018, covered 2009-2012. All previous organic agriculture statistics reports can be accessed at https://aic.ucdavis.edu/research1/organic.html.

“This report of organic data continues the series of studies initiated by Karen Klonsky many years ago. It contains vital summary information for industry and policymakers as well as researchers,” said Goodhue.

Since the data collection began in 1994, the number of organic growers in California has increased 2.8-fold to 3,109 and the farm-level sales 40-fold to $3.1 billion in 2016.

“Accurate annual data on California organic crop production, acreage and value is critical to understanding the scale and scope of this growing agricultural sector,” said Wilson. “As the UC Organic Agriculture Institute begins to develop research and extension programs, it is important that we have a reliable way to assess the extent and geography of organic production as well as track changes over time.”

Muramoto, who became the UC Cooperative Extension organic production specialist in 2019, collaborated with Goodhue, Daniel Sumner, director of the UC Agricultural Issues Center and UC Davis professor of agricultural and resource economics; and UC Davis graduate student Hanlin Wei to produce the latest statistical review of California's organic agriculture.

More recent years are not included because the data collected by CDFA changed in 2017 and again in 2019 so they are not comparable to the data in this report. The full report can be downloaded from the UC Agricultural Issues Center website at https://aic.ucdavis.edu/2020/10/06/statistical-review-of-californias-organic-agriculture-by-wei-goodhue-muramoto-and-sumner.

Why are farmers destroying crops while store shelves are empty?

Empty grocery store shelves are troubling enough to California consumers who are accustomed to abundant supplies. To hear about farmers dumping milk, crushing eggs and plowing under crops when demand for food is strong just doesn't make sense to most consumers. Although the new coronavirus crisis has currently derailed the connection between supply and demand, “the food system in the United States is resilient and there is little reason for alarm about food availability,” write University of California agricultural economists.

Overall, neither food consumption nor the amount of food supplied by farms have changed much, they write in a new article published by UC's Giannini Foundation of Agricultural Economics. The authors explain that the sudden closure of schools, restaurants and other institutions, coupled with residents in many states sheltering in place to reduce the spread of COVID-19, has disrupted normal patterns of where people buy food.

“Price changes, surpluses and shortages along the food supply chain are likely the result of recent and temporary shocks to supply, demand or both,” said co-author Ellen Bruno, UC Cooperative Extension specialist in the Department of Agricultural and Resource Economics at UC Berkeley.

“On the demand side, we have seen customers shift to buying more food at the grocery store as restaurants and other food service businesses have closed. Plus, consumers have changed what they consume and stockpile during these times,” she said.

Initially, worried consumers stocked up on staples such as rice and pasta that store well. Then, with more free time, they started cooking at home and baking their own bread and pastries, buying up eggs, flour, sugar and other baking supplies.

“On the supply side, there are challenges in trying to rearrange production and packaging to service grocery stores, as opposed to restaurants, schools, etc. which often purchase items in different quantities,” Bruno said. “Plus, there are the obvious health concerns and potential disruptions due to the impact of the virus on the workers themselves.”

How quickly the food supply system will adapt to changing demand depends on the product, according to Bruno and her co-authors Richard J. Sexton, UC Davis professor, and Daniel A. Sumner, director of the UC Agricultural Issues Center and UC Davis professor, both in the Department of Agricultural & Resource Economics. Canned fruits and vegetables are often processed shortly after harvest and can be moved from storage to retail fairly quickly. To increase egg production, farmers have to add to the number of laying hens, which takes months. Many perishable produce items are planted, harvested, packed and shipped according to a precise schedule to replenish grocery store inventories “just in time” so farmers can't quickly increase the amount of fresh fruit and vegetables they supply.

Produce wholesalers who sell to food service have products and packaging specifically designed for that market. For example, packing plants that prepare large bulk salad packages for restaurants aren't set up to pack salad into retail-ready bags that require consumer labels. While adjustments were made, some fresh produce rotted or was plowed under.

After the COVID-19 disruption ends, the authors expect the food supply chain to evolve as the economy gradually recovers.

“In the longer term, even after restaurants and the food service industry are back and running, reduced incomes due to the recession will change our consumption patterns,” Bruno said. “Demand for food consumed at home doesn't change much with income, but demand for food at restaurants does. In many ways, food service and the growers that supply directly to food service will be hardest hit by all of this because they suffer both in the short run with mandatory closures and in the long run with an economic recession.”

Although it's uncertain how long the pandemic will last, the authors say Americans will have an adequate supply of safe, healthy food.

“Despite these disruptions, overall our food supply chain is robust and adaptable,” Bruno said. “Nothing in the underlying economics suggests that there will be a lack of food available.”

To read “The Coronavirus and the Food Supply Chain,” visit https://bit.ly/covidimpactonfood.

U.S. honey industry contributes more than $4.7 billion to economy, according to Ag Issues Center report

The U.S. honey industry is thriving, according to a new study from the University of California Agricultural Issues Center (AIC). The research found that the U.S. honey industry in 2017 was responsible for more than 22,000 jobs and its total economic output was $4.74 billion. Total economic output includes direct effect, such as workers hired to move beehives, indirect effect, like packaging supply companies for honey products, and induced effects, the wages honey industry workers spend at local businesses.

The study was directed by Daniel A. Sumner, an economist and director of the AIC, an institute which has studied the economic impacts of many farm commodities. The U.S. honey industry is made up of beekeepers, importers, packers and processors.

"The U.S. honey industry contributed significantly to jobs and economic activity across many states and regions in the United States," Sumner said. "In addition to its direct economic contributions, as an important ingredient, honey contributes flavor to a wide variety of food products and stimulates demand across the food industry."

The honey industry contributed approximately $2.1 billion in value added to the U.S. gross domestic product (GDP) in 2017. For scale, Vermont Maple contributed $34 million to the Vermont economy in 2013.

"While beekeeping is a labor of love and the true essence of a craft industry, the honey industry's size and scope shows that honey production makes a significant impact on our nation's economy," said Margaret Lombard, CEO of the National Honey Board. "From beekeepers in Washington state to packers in Maine, the honey industry's impact is evident across the country—as well as in the overall U.S. GDP."

In 2017, the honey industry employed more than 22,000 individuals across the U.S. in production, importation and packing jobs. The Vermont Maple industry employed 4,021 in 2013.

In addition to a thriving industry, the American appetite for honey is growing. In 2017, Americans consumed 596 million pounds of honey or about 1.82 pounds of honey per person, which represents a 65 percent increase in consumption from 2009 to 2017.

To learn more about the University of California Agricultural Issues Center, visit https://aic.ucdavis.edu. Find the full "Contributions of the U.S. Honey Industry to the U.S. Economy" study here. For more information on the National Honey Board, visit www.honey.com.

About National Honey Board

The National Honey Board (NHB) is an industry-funded agriculture promotion group that works to educate consumers about the benefits and uses for honey and honey products through research, marketing and promotional programs. The board's work, funded by an assessment on domestic and imported honey, is designed to increase the awareness and usage of honey by consumers, the food service industry and food manufacturers. The 10-member board, appointed by the U.S. Secretary of Agriculture, represents producers (beekeepers), packers, importers and a marketing cooperative. For more information, visit www.honey.com.

About University of California Agricultural Issues Center at UC Davis

The University of California Agricultural Issues Center (AIC) was established in 1985 to research and analyze crucial trends and policy issues affecting agriculture and interlinked natural and human resources in California and the West. The Center, which consists of a director, several associate directors, a small professional staff and an advisory board, provides independent and objective research-based information on a range of critical, emerging agricultural issues such as food and agricultural commodity markets, the value of agricultural research and development, farm costs and returns, consequences of food and agricultural policy and rural resources and the environment. The audience for AIC research and outreach includes decision makers in industry, non-governmental organizations and governments as well as scholars, journalists, students and the general public.

California food choices won’t save much drought water, researchers find

Can you help fight the California drought by consuming only foods and beverages that require minimal water to produce?

Well, as the old saying goes, the devil is in the details. In a recently published paper, Daniel Sumner, director of the UC Agricultural Issues Center at UC Davis, and research assistant Nina M. Anderson mine the details of this issue to help us all better understand just what impact our food choices can have on conserving California's precious water.

To begin with, not all water drops are equal because not all water uses impact California's drought, the researchers explain.

Drought-relevant water

So just what water does qualify as California drought-relevant water? You can definitely count surface water and groundwater used for agricultural irrigation as well as water used for urban purposes, including industrial, commercial and household uses.

And here are a few examples of what water is not relevant to California's drought:

-- Water used in another state to grow animal feed that is consumed by California livestock;

-- Water used in another state to produce young livestock that are later shipped to California for food production; and

-- Rain that falls on un-irrigated California pastureland. (Studies show that non-irrigated, grazed pastures actually release more water into streams and rivers than do un-grazed pastures, the researchers say.)

In short, California's drought-relevant water includes all irrigation water, but excludes rainfall on non-irrigated California pastures as well as any water that actually came from out-of-state sources and wound up in livestock feeds or young livestock eventually imported by California farmers and ranchers.

Also, the amount of water that soaks back into the ground following crop irrigation doesn't count – and that amount can be quantified for each crop.

Comparing water use for various foods

I think you're getting the picture; this water-for-food analysis is complicated. For this paper, the researchers examined five plant-based and two animal-based food products: almonds, wine, tomatoes, broccoli, lettuce, milk and beef steak.

In teasing out the accurate amount of water that can be attributed to each food, the researchers first calculated how much water must be applied to grow a serving of each crop or animal product. Then they backed off the amount of water that is not California drought-relevant water, arriving at a second figure for the amount of drought-relevant water used for each food.

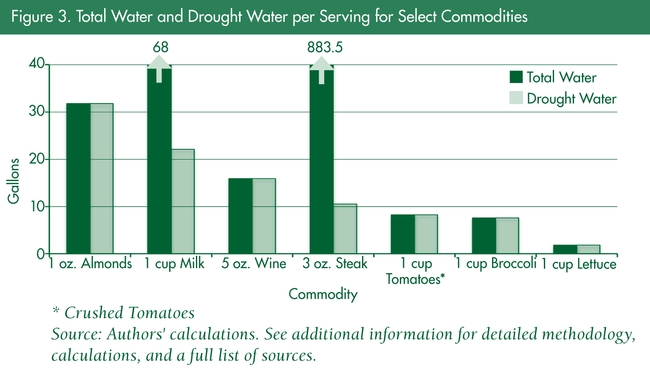

They provide a terrific graph (Fig. 3) that makes this all quite clear, comparing total applied water with California drought-relevant water used for the seven food products.

Milk and steak top the chart in total water use, with 1 cup of milk requiring 68 total gallons of water and a 3-ounce steak requiring 883.5 total gallons of water.

But when only California drought-relevant water is considered, one cup of milk is shown to be using 22 gallons of water and that 3-oz steak is using just 10.5 gallons of water. (Remember, to accurately assess California drought-water usage, we had to back off rainwater on non-irrigated pastures and water applied out of state to raise young livestock or feed that eventually would be imported by California producers.)

“Remarkably, a serving of steak uses much less water than a serving of almonds, or a glass of milk or wine, and about the same as a serving of broccoli or stewed tomatoes,” write Sumner and Anderson.

Still skeptical? Check out their paper in the January-February issue of the “Update” newsletter of the Giannini Foundation of Agricultural Economics at http://bit.ly/1XKZxxC.

Bon appetit!